|

HOME | LISTINGS SEARCH | BUYER'S GUIDE | SELLER'S GUIDE | RESOURCES | |

|

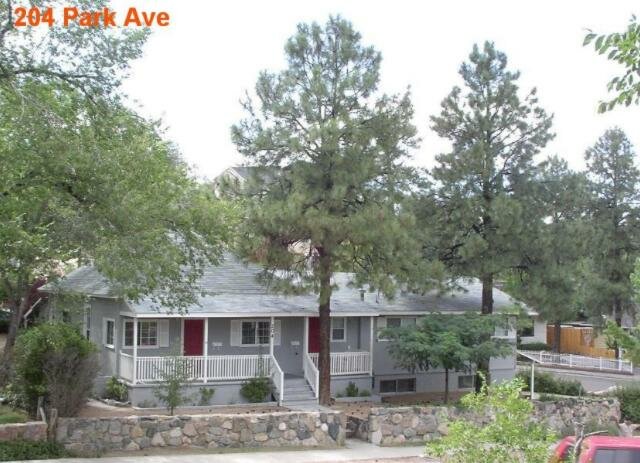

Prescott's Real Estate Investment |

|

|

PRESCOTT REAL ESTATE BUYER'S GUIDE |

| Define Your Investment Goals |

|

| Identify Your Needs & Desires |

|

| Know Your Financial Readiness |

|

| Find an Income Property Advisor |

|

| Establish a Relationship with a Lender |

|

| Develop a Purchase Strategy |

|

|

|

|

|

|

|

| The rapport that you establish with a lender is key to your future financial success in Prescott real estate investing. When looking for a company or individual to handle your mortgage there are several points you should consider: |

|